Special Report - was said by W.D. Gann

Mr. Gann's words are still valid today. Gann said: Every movement in the market is a result of a natural law and from a Cause which existed long before the Effect takes place which can be determined years in advance. The future is but a repetition of the past, as also said in the Bible. Every Top or Bottom in any commodity market comes out in accordance with an exact mathematical proportion to some other previous high or low level, top or bottom.

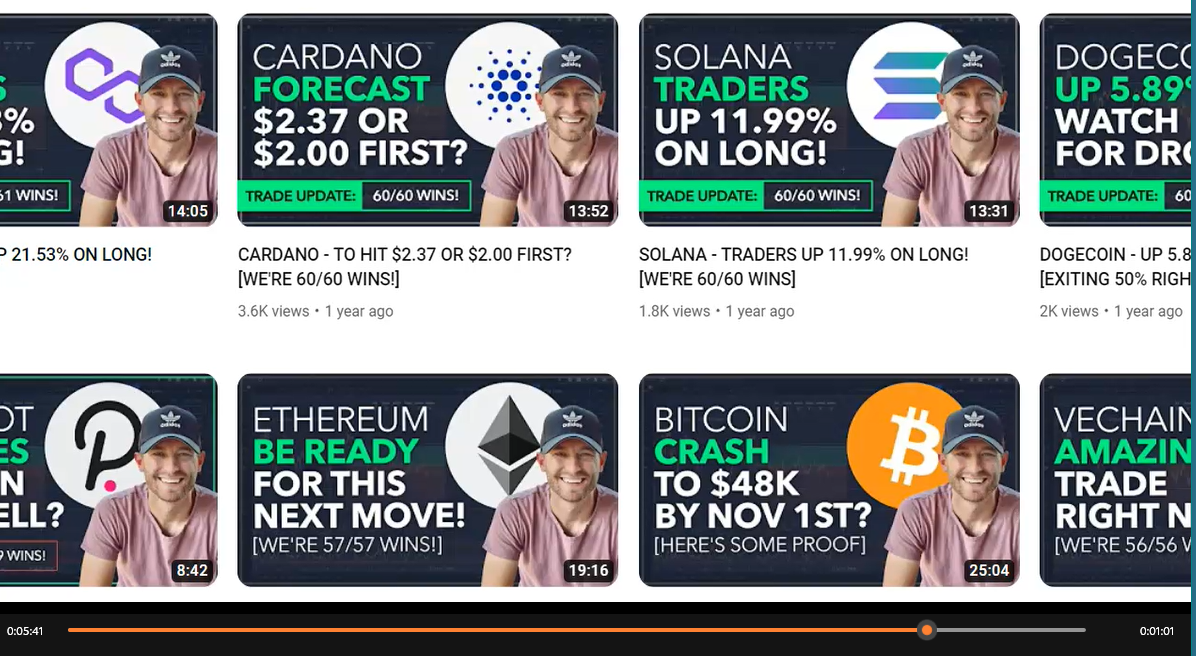

Our Semi-Annual Special Report is About How You May Be Easily Fooled by a site like "TradeConfident.io" by implying they are an Expert Trader from hyping a poorly disclosed over-pumped Crypto Trading Method. A place you can learn how a Marketing Guru can succeed! Warning from Anonymous Trader

TradeConfident.io Review. We never traded Crypto before, starting in 2021 (following the big Dogecoin pump) we started trading Crypto and losing tons of money following Trade Confident LLC trades. Since "TradeConfident" was a California USA trader; Trade Confident was not able to go short and only go long (due to U.S. cryptocurrency market regulations) so subsequently all "Trade Confident" trading signals from "TradeConfident.io" were long trades only.

People are searching for these terms: Online trading,

Stock trading,

Web-based trading,

Internet trading,

Online stock trading,

E-trading,

Web-based stock trading,

Online investment,

Online broker,

Web trading platform

"TradeConfident.io" T.M. gave new daily trade signals in cryptocurrency markets recommending buying using 3/4 market structure levels. It was based on dollar cost average buys and as price dropped to new lower levels you would buy more on way down at 3 or 4 lower levels being hit, based on obvious support areas.

IMO, that "TradeConfident" dollar cost average buying as market declines may possibly "work" to a degree in bull markets but certainly not "work" in bear markets! T.M. "TradeConfident.io" said trade status with open trade updates will be posted daily via TradeConfident Telegram Channel however we don't recall our open trades ever being updated (or anyone else's trades) or even mentioned on Telegram, on numerous Trade Confident videos or "TradeConfident.io" website.

T.M. the "TradeConfident.io" owner and marketing genuis desired a unique and powerful way to market costly paid monthly membership and costly software products regardles of his recommended trades making profits or being losers! Thus TradeConfident.io devised an incredibly strong marketing campaign to sell his monthly membership and costly software to both current and new traders.

TC allegedly decided the best promo was by heavily advertising vast numbers of consecutive wins and zero losses (one loss he was later forced to disclose since everyone lost when Luna failed) and implying large profits. However, success was impossible unless he can figure out what to do about the pesky big drawdowns.

The answer Trade Confident owner allegedly decided to use was a marketing genius plan to keep losers for ages, if necessary, as long as 6-months (based on what I noticed). As a result, there are no (closed) losing trades to damage the marketing blitz, only winners to report, by down-playing or not talking about trades with drawdowns while heavily promoting consecutive winners, with little if any mention of the wins being surprisingly small (more on that aspect later).

Another important reason for our 75k losses was from "TradeConfident" ongoing bumping-down profit targets (without clear disclosure on doing that)! We were not advised to do it so continued to keep the original high profit level target prices! That made things much worse by us ending up with fewer winners but holding even more losers because our target prices were rarely if ever hit due to target prices being T.M. recommended initial high profit potential fixed prices.

That was because he would set a substantial target price when trades were recommended, i.e. 1k or more but he often bumped-down targets until profits averaged only $70 however, in the meantime, we did not do that since we do not recall it being part of the trading plan and don't recall that very important aspect being announced with the trades.

When we noticed the stated profits were substantially less than expected from his heavily advertised 122 straight wins, we were suspicious so we asked "Trade Confident" by email what's the average profit per trade? T.M. replied "if you traded $1,000 the likely profit will be around $70. Hope this clarifies!" P.S. 1k was suggested account funds to be used for a new trade.

The low $70 average extrapolates to only $8,540 total profit on 122 trades. And to make it far worse, if you deduct for the open trades in heavy equity drawdowns the bottom line would be a hugely negative number (estimated at roughly negative 50/100k, based on the TradeConfident 150k account). Only a marketing expert and guru could somehow make such bad numbers succeed!

We informed T.M. we always thought the TC average win was at or near original targets, which was far more vs just $70. We went on to say "We were not aware until it was too late to help that you were constantly moving target prices to very low levels however, we stuck to original substantial high take profit prices, which you should have disclosed when we joined and referred to as trades progressed."

TradeConfident.io had a perfect marketing success plan, after all what could possibly be a better for successful hype than claiming a perfect track-record, with no losing trades and subsequent implication of big profits!

We admit to being more or less blinded by his numerous consecutive winning trade hype and nonsense to think about the negativity and disaster from what he was doing (or not-saying, non-revealing) until it was too late and lost 75k by following his daily trade recommendations over a few months.

That was caused by being fooled (we admit it was not too smart of us) by T.M. and his "Trade Confident" ongoing strong marketing from T.M. and "TradeConfident.io"' who we followed on YouTube and Telegram and fooled us for ages with a stunningly misleading marketing campaign.

Shortly before closing the account, we emailed TM asking "Why did you stop showing account balance in videos? How low is the equity?" T.M. did not address that question but did say I'm not gonna lie, losses are 45k. We went on to say in June 2022 after losing a ton of money and being out of funds we cannot trade anymore. We then stopped using the TradeConfident.io website, videos, YouTube channel, software, telegram group and canceled the account.

We had strongly and wrongly believed T.M. and "Trade Confident" to be highly successful. After all, how in the world could it not, what with as many as 122 consecutive winners? The odds for T.M. & Trade Confident being losers appeared impossible. With all those consecutive wins we were sure about using a winning traders signals and more or less blinded from heavy ongoing marketing to both prospects and existing clients hyping an amazing track record.

As time went by, we slowly realized the truth as our losses mounted. At least T.M. was honest by admitting to us his average winner was just $70. So that number brings out our calculator revealing about 8k in profits from 122 winners, with approximately 50k (maybe a lot more) in obscure rarely discussed open trade losses! He got away with a highly big negative track record by not publicizing open losing trades but concentrating heavy marketing on the small winners.

While we were with Trade Confident (and also long before) basically every YouTube video promo referred to tons of consecutive winners. The 122 winner pump headline quickly went away mid-June 2022 (122/122 wins) after running intensely for 9-months starting Sept 2021 (33/33 wins).

The timing of Trade Confident major advertising redirection was quite interesting in that it was exact same week we made our final complaint and canceled TradeConfident.io membership over our heavy losses. All losses attributable to the many reasons discussed in this "Trade Confident Review" from me; The Anonymous Trader.

That's when we also requested reimbursement for high losses. It's basically the exact same time TradeConfident suddenly stopped the 100s of winner pumping videos, with little if any comparative mention about the small 2-figure wins over time or that estimated overall 50k-100k account equity drawdown!

We are confident that big YouTube promotional change was closely related to myself (and in all likelihood) other traders asking "Trade Confident" how am i losing big time in view of Trade Condident's amazing track record of wins.

That stunning long-running marketing blitz where T.M. rarely if ever mentions any losing trades, drawdowns and the small ($70) win trades appears to have started Sept 9 2021, lasting 9-mos thru June 2022. Possibly another reason T.M. suddenly stopped its powerful false hype was conjecture the SEC or CFTC may investigate "TradeConfident" so best to sharply reduce advertising hype.

If you view the new

4-min MP-4 Video (a new screen appears every 4-seconds) you will see first headline on the consecutive winners (33/33) at end of our video which T.M. made Sept 9 2021. By watching this

new MP-4 video you will see the powerful TradeConfident pumping and hype from beginning of video recent top (122/122) when it wound down, to a degree, to its (33/33)

onset.

Copyright Disclaimer under Section 107 of the copyright act 1976, allowance is made for fair use for purposes such as criticism, comment, news reporting, scholarship, and research.

The Commodity Futures Trading Commission or The SEC could possibly get involved regarding the track record marketing of 33 to 122 consecutive winning trades (zero losses or 1), based on a dubious value "dollar cost average" trading methodology of keeping obscured losers for months to market a perfect record!

With 20-20 hindsight, we understand what happened. Don't be misled and deceived as we were by "Trade Confident" and others, who are much better at marketing vs actually making money! Stay away from "Trade Confident LLC"

Below are some messages (minor edits) sent to "Trade Confident"

Your disappointingly low average win is not disclosed as it should be and was a serious lack of clarity on direction of open trades when you did not tell us to get out with small profits as you did on your own trades, and it also turns out it involves undisclosed until we asked small $70 on average, with an approximate near 100k overall equity drawdown vs insignificant 8k in profitable trades.

We are thinking if someone like myself with experience could become confused on what you were doing, not saying or not disclosing, there is a strong possibility new traders may also be very confused so a need for education is beneficial. It can help traders make good decisions and be alert for pitfalls and negatives before using a trading method (any system not just "TradeConfident.io" to help traders avoid losing their money. Done without intent to harm reputations.

You said numerous times in your videos you will let us know when to exit trades and make changes to positions but not once do we recall you saying change targets to a level near a $70 profit area, as you were doing yourself, in effect.

You did the dramatically modified low profit price orders on your winning trades but we did not do that because we wrongly believed we were both using your original high profit target prices since you said you would give instructions in Telegram Channel if you deviated however, we do not recall you ever doing that on any of the trades we were in.

You totally failed to talk about and update the recommended old and open trades of clients but focused only on the latest new trades, ignoring open trades of members. Thus, we strictly followed original 3 or 4 trade-levels stops and targets and never modified orders to extremely reduced profit levels, as you were doing.

We are not sure why (was it neglect, forgetting, not caring or not thinking well?) you failed to inform us to modify trade target and stop prices as you did! In retrospect, if we also moved target prices down to very low levels (more or less equaling about $70) by not staying with original prices we could have far more winners and lower loss size i.e. instead of losing 1k or more per trade.

At first, we didn't realize you were failing on open trade guidance because you spoke far too much about far less important stuff like software sales for example, so we assumed your P&L was substantial and you were making tons of money with original profit targets. With 122 wins how can you not have good P&L?

Sometime later we realized your account equity (sometimes quickly shown in videos) was a fraction of the 150k total you had been trading (100k to start plus 50k more later added) so it all made zero sense to us. How could you be down roughly 100k in equity from 150k with 122 straight wins, seemed impossible.

It was a late revelation and slow realization on your average winner being $70. So, if we multiply 120 wins times $70 it means your profit was only about $8,400 which is 120 times $70. So that very roughly extrapolates based on a recent post you made showing 55k account equity, that you lost or had negative equity of about 95k (near $100,000 drawdown) on total 150k in your broker account.

T.M. appears to be an honest Christian so it's unlikely all that stuff was done with fraud intent but instead we are guessing maybe it was because of you not thinking straight about what you were doing, saying, not saying or a general failure to communicate. Possibly from high pressure due to your period of rapid growth and being so heavily focused on a marketing plan using the 100 plus wins with no losses. BTW, we think we are entitled to compensation for the big loss!

Please Note, we believe all reports, opinions, assumptions, data and numbers are valid however, accuracy is not assured and it is all "alleged" it's also possible some data may not be accurate due to "Trade Confident LLC" limited transparency and confusing reports. If there are any errors, misstatements or incorrect allegations contact us and it can be corrected, clarified or redacted.

Update. It's quite interesting how "Trade Confident" went from making 100s of YouTube's announcing from 33/33 to 122/122 consecutive wins ending its big promo several mos ago and on Nov 7 2022 T.M. is now headlining on YouTube that 'Trade Confident' has "only" 18/18 straight winners? Why & How is it even possible?

Update. It's quite interesting how "Trade Confident" went from making 100s of YouTube's announcing from 33/33 to 122/122 consecutive wins ending its big promo several mos ago and on Nov 7 2022 T.M. is now headlining on YouTube that 'Trade Confident' has "only" 18/18 straight winners? Why & How is it even possible? Copyright Disclaimer under Section 107 of the copyright act 1976, allowance is made for fair use for purposes such as criticism, comment, news reporting, scholarship, and research.

Our Yearly Special Report (below) is About the Best Markets to Trade and W.D. Gann Methodology.

Both traders and brokers often consider forex the "best market" to trade

because of its great liquidity by being the largest financial market in the world and also long trading hours. However, forex trading involves high-risk, thus in addition to FX, traders should also consider trading other markets, including stocks, options and futures markets.

The Top-17 most liquid futures-markets we recommend for trading (rankings based on liquidity) are these; The #-1 liquid market S&P-500 E-Mini (GLBX), 10-Year T-Notes (CBOT), Crude Oil (NYMEX), Russell 2000 Mini (ICEUS), 5-Year T-Notes (CBOT), Euro FX (CME), T-Bonds (CBOT). Ultra T-Bonds (CBOT), E-Mini Nasdaq-100 (GLBX), Soybeans (CBOT), 2-Year T-Notes (CBOT), British Pound (CME), Gold (COMEX), Natural Gas (NYMEX), Gasoline (NYMEX), Eurodollar (CME), Corn (CBOT).

The more manageable size, lower margin needed, comparatively less risky and well diversified 10-market portfolio which we personally like (and our trading system prefers) with reasonable or high liquidity consists of these mini-markets:

S&P 500 Emini (CME)

Nasdaq 100 Emini (CME)

Dow Jones Emini (CME)

10-Year T-Notes (CBOT)

30-Year US Bonds (CBOT)

Euro/USD (CME)

YPY/USD (CME)

Crude Oil (NYMX)

Gold (COMEX)

Soybeans (CBOT)

Of course, the financial markets have diverse short-term and long-term price ranges, volatility, contract sizes and tick values. That results in somewhat mixed P&L results based on one single contract being traded.

Therefore, to level the playing field the estimated number of contracts to trade are shown (next to exchange name) to achieve approximately equal dollar profits.

The P&L equalizing number of contracts is based on the maximum possible price changes seen over past few years vs contract values. For example, based on recent monthly liquidity reports; trading just 1 Crude Oil (NYMX=1) contract per signal is comparable in profits and losses incurred over time vs trading 9 contracts of Corn (CBOT=9) for every trade made.

As a side-note, some of the worst and more difficult futures markets to trade with typical low liquidity, combined with potential erratic price behavior and subsequent high risk are Coffee, Sugar, Orange Juice, Cotton, Platinum, Chinese Yuan (and several other currencies), Silver and Heating Oil. P.S. That's a more or less subjective list based to a degree on the Editor's opinion.

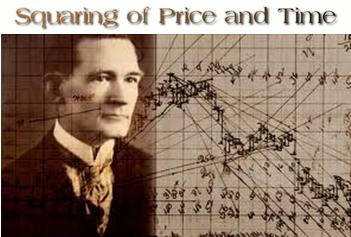

This Month's Featured (Historical) Special Report on is on famous old-time trader Mr. W. D. Gann who was quoted in the media by a reporter saying "the trouble with most chart-traders is they work with only one factor which is space movements or charts which record 1 to 2 points up or down. However, there are three or more factors to be considered, space, volume and TIME. The most vital is time, and the time-factor is the cause of recurrence of high or low prices at certain intervals"

A financial media reporter said this on W.D. Gann's incredible trading ability: "One of the most astonishing calculations made by Mr. Gann was when his (early in year) long-range prediction was Sept Wheat would sell at $1.20. This meant it must touch that figure before the end of the month of September. At 12-noon Chicago time on September 30th (the last trading day) the contract was trading below $1.08 and it looked as though Gann's prediction would not be fulfilled.

Mr. Gann said, 'If it does not touch $1.20 by the close of the market it will prove there is something wrong with my whole method of calculation. I do not care what the price is now, it must go there.' It's history that Sept Wheat surprised the whole country by selling at exactly $1.20 and no higher in the very last hour of trading, closing at exactly $1.20

More about trading fx currencies; Forex futures robot testing web-sites have been testing robot after robot to find one which really works. As far as we know, upon their testing not even one automated forex robot has ever been found which actually worked in real-time trading (without the benefit of 20-20 hindsight) for traders looking for ways to successfully trade currency markets.

We have now come to a  conclusion none of the forex robots really work or perform consistently on their own. It seems most don’t do much more than sooner or later wiping out your account balance.

conclusion none of the forex robots really work or perform consistently on their own. It seems most don’t do much more than sooner or later wiping out your account balance.

There's a lot more to making money trading fx-futures than offered by most mechanical trading systems. It's quite hard to make regular profits in

forex currencies trading, and following all the trade signals generated by a

forex futures trading system to make money in the forex market. The good news is there is hope, in particular if combining a good trading system with time-tested Gann techniques (read more about Mr. Gann below) to trade forex, stocks and commodities markets.

Learn about W D Gann methods by buying Webtrading's Gann Course → →

We can teach you how to trade the financial markets for profit using Gann's best trading methods and understanding how to correctly use Gann Angles.

In our opinion, the most significant Gann trading method (and perhaps the easiest technical tool for many traders to learn and effectively use) is in fact Geometric Angles, which Mr. Gann used so extensively in his long trading career.

Keep in mind, Gann Angles are natural and not necessarily complex or difficult to learn and master. With that said, geometric angles do need considerable study time, with an open mind and confidence, the understanding on angles use for new trade signals, where to expect market turning-points and knowing where valid and strong resistance and support areas are located on your price charts.

In addition to the extremely meaningful angles, it's also important to learn about the squaring of price & time, using valid Gann style construction "square charts" and Gann charting methods, support & resistance numbers and levels, "Gann numbers" and numerology. This Gann Trading Course teaches Gann's amazing methods for successful trading of commodities and stocks.

If you closely read and study our unique Gann Course it's quite likely you will learn how to use and implement important Gann trading methods in your trading within 72-hours. 3-days is also the (minimum) time we suggest you set-aside to study and grasp the trade techniques.

Extensive additional learning and studying is not usually needed or is it typically necessary. Nevertheless, more help is available if a trader desires more guidance or making it more logical. If that's applicable to your particular situation, we suggest you consider hiring a trader expert who can assist you on a much more personal level with  trading consultation.

trading consultation.

This Gann traders' course was written by Dave of web.trading who has studied and used Gann style trading methods for the past 30-plus years, including intense "squaring price and time" research and study. He is considered an expert on Gann and has worked hard on making the method understandable.

Trading the financial markets using Gann can work well when trading most any futures, forex, indices or stocks. Gann was much more involved in inter-day (position trading) vs intra-day (day trading) and therefore mostly used daily bar-charts.

With that said, Gann trading techniques can also be used to day-trade the markets, what with Gann methods also being applicable to intra-day bar charts such as hourly charts (and shorter time-frames). Day trading was not nearly as popular during Gann's time vs now, if it was, you can be sure Gann would have used geometric angles to make big money day trading too.

Please search our powerful trading search engine a place to do research or ask questions about any trading subject of interest when seeking daytrading or position trading info and learn about trading.

You may type-in specific market names (bonds, corn, etc) and use keywords, phrases, terms, questions; i.e., how to make money trading gold, how to day trade for profits, ways to lower risk, making money by trading options, daytrading secrets, how to trade soybeans, what is forex trading, etc.

Here are some (but not all) of the key subjects covered in our highly recommended Gann Techniques Trading Course, which can effectively be used to trade the stock market or futures markets using our course based on Gann's unique trading methods.

Our Gann trading course contains much of Gann's secrets and techniques to potential successful trading of commodity futures, forex currencies, stock indices and the stock market, using "hands-on Plain English" learning skills.

We are including in the lessons, charts, plus annotated copies of Mr. Gann's old charts done in his own hand-writing. Our Gann Trading Course also comes with a unique custom-made acrylic custom Gann angles tool, with instructions for drawing Gann angles on Gann method type of 'square' price charts.

In this Gann Course we address issues such as: Did W. D. Gann use Astrology in his Trading (the answer may surprise you); Square Chart Definition and Usage; How to Make a Gann-style Square Chart, Squaring Price and Time; Geometric Angles; Which Gann Angle is most important (answer about why it's so powerful is surprisingly easy to comprehend); Angle Concepts; Gaps on Charts; What Causes Chart Gaps; Square of Nine and other Gann related methods, plus more about the Squaring of Price and Time.

Why spend $1,000 or more elsewhere to learn these techniques when you can learn the best methods in this course at such low-cost. Please note, some methods may use our own interpretation, added twists or variations, better understandability and ease-of-use, added tools, or used in ways to improve trading results. All that at a bargain price of only $97 with free S&H in the USA (Non-US traders please contact us for cost with foreign shipping).

This potentially highly profitable Gann Secrets (explained) trading course offers

Gann traders (both new and experienced), the secrets and knowledge needed to blend Gann trading techniques into commodities, futures & stock market trading decisions, which can bring you profits. Click-on Buy Now Button...

Gann traders (both new and experienced), the secrets and knowledge needed to blend Gann trading techniques into commodities, futures & stock market trading decisions, which can bring you profits. Click-on Buy Now Button...

Trading Resources

Alternative Investments

Alternative Investments

Club Membership

Club Membership

Commodity Markets

Commodity Markets

CTCN Back-Issues

CTCN Back-Issues

CTCN Newsletter

CTCN Newsletter

Commodity Traders Glossary

Commodity Traders Glossary

Forex Currencies Guide

Forex Currencies Guide

Gann Commodity Course

Gann Commodity Course

Gann Techniques Course

Gann Techniques Course

Gann Trading

Gann Trading

How to Make Money Trading Options

How to Make Money Trading Options

1,000s of Pages of Trader Resources

1,000s of Pages of Trader Resources

Natures Law Secret of Universe

Natures Law Secret of Universe

Phantom of the Pits

Phantom of the Pits

Risk Disclosure Statement

Risk Disclosure Statement

Special Reports

Special Reports

Technical Indicators

Technical Indicators

Tips for Beginners

Tips for Beginners

Trader Testimonials

Trader Testimonials

Trading System Evaluation

Trading System Evaluation

Trading System Waiting List

Trading System Waiting List

Trading with Low-Risk

Trading with Low-Risk

Webtrading.com

Webtrading.com

What's New

What's New

Buy or Lease web.trading Now at Dan.com (a GoDaddy Brand), or use Escrow.com to buy it, or ask any questions by clicking-above or emailing us...

Today's Date and Time

Copyright© Webtrading™1996-2024

Webtrading®2001

Privacy-Policy | All Rights Reserved

Update. It's quite interesting how "Trade Confident" went from making 100s of YouTube's announcing from 33/33 to 122/122 consecutive wins ending its big promo several mos ago and on Nov 7 2022 T.M. is now headlining on YouTube that 'Trade Confident' has "only" 18/18 straight winners? Why & How is it even possible?

Update. It's quite interesting how "Trade Confident" went from making 100s of YouTube's announcing from 33/33 to 122/122 consecutive wins ending its big promo several mos ago and on Nov 7 2022 T.M. is now headlining on YouTube that 'Trade Confident' has "only" 18/18 straight winners? Why & How is it even possible?

![]()

![]()

conclusion none of the forex robots really work or perform consistently on their own. It seems most don’t do much more than sooner or later wiping out your account balance.

conclusion none of the forex robots really work or perform consistently on their own. It seems most don’t do much more than sooner or later wiping out your account balance.  trading consultation.

trading consultation. Gann traders (both new and experienced), the secrets and knowledge needed to blend Gann trading techniques into commodities, futures & stock market trading decisions, which can bring you profits. Click-on Buy Now Button...

Gann traders (both new and experienced), the secrets and knowledge needed to blend Gann trading techniques into commodities, futures & stock market trading decisions, which can bring you profits. Click-on Buy Now Button...

![]() How to Make Money Trading Options

How to Make Money Trading Options![]() 1,000s of Pages of Trader Resources

1,000s of Pages of Trader Resources![]() Natures Law Secret of Universe

Natures Law Secret of Universe